Managing your finances can seem challenging, but it doesn’t have to be. With the right tools, you can control your money, save for the future, and reduce stress about your finances. This guide will explore the best free personal finance software in 2025 to help you take charge of your financial future.

Section 1: Why Use Personal Finance Software?

Understanding the Basics

Personal finance software helps you track your money. It organizes your income, expenses, savings, and even investments. These tools make financial management simpler and smarter.

Benefits

- Easy Budgeting: See where your money goes.

- Savings Goals: Set goals and watch your progress.

- Tracking in One Place: Keep income, spending, and savings in one app.

Challenges

- Privacy Concerns: Some worry about data safety.

- Learning Curve: It might take time to understand some apps.

Who Can Use It?

Everyone! Students, professionals, or families can benefit from these tools. Whether you want to save more, pay off debt, or control spending, there’s an app for you.

Section 2: Top Features of Good Finance Apps

Not all apps are the same. Before choosing, look for these features:

1. Account Syncing

Connect your bank account, credit cards, or loans. This updates your app with real-time data.

2. Goal Setting

Want to save for a car or a trip? Apps with goal-setting help you track every step.

3. Security

Choose apps with encryption and strong privacy policies to protect your data.

4. Customization

Every person’s finances are unique. Find apps that let you create custom budgets and categories.

Section 3: The Best Free Personal Finance Apps in 2025

Now, let’s review some top choices.

1. Mint

- Why Choose Mint?

Mint tracks all your accounts in one place. It shows your spending habits and suggests ways to save. - Features:

- Free budgeting tools.

- Credit score monitoring.

- Custom alerts for bills.

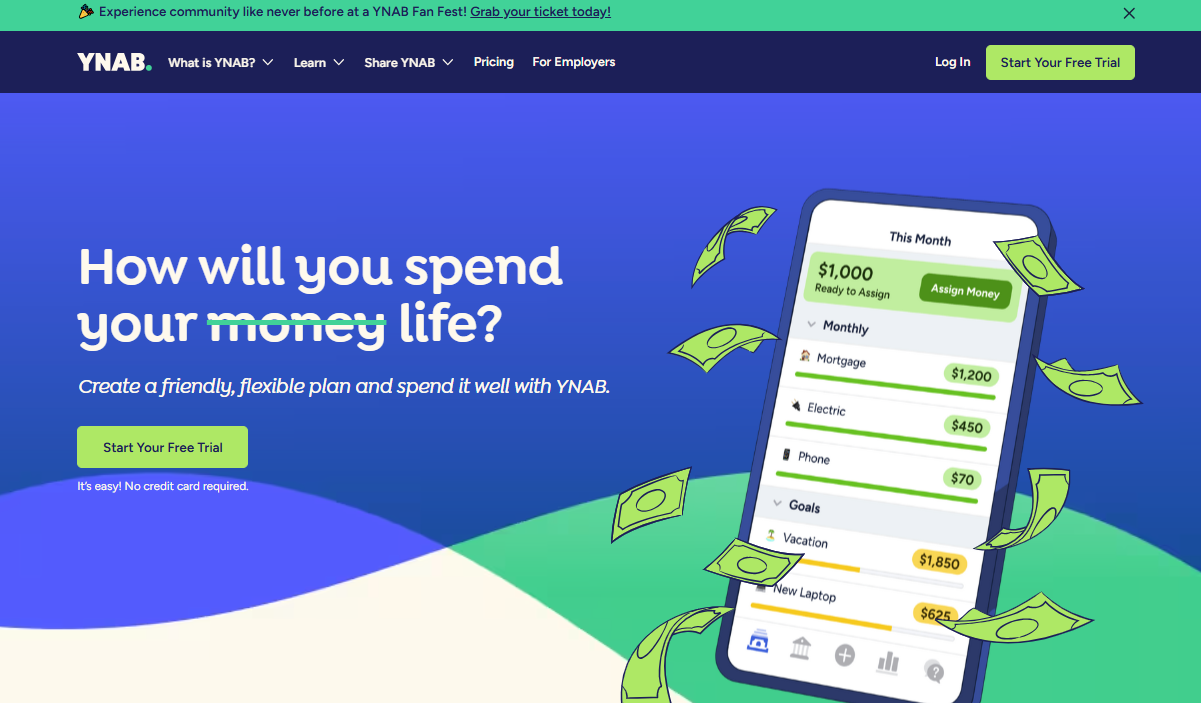

2. YNAB (You Need A Budget)

- Why Choose YNAB?

This app focuses on assigning every dollar a purpose. Perfect for people who want strict control. - Features:

- Detailed spending categories.

- Great for debt payoff plans.

- Syncs with devices.

3. PocketGuard

- Why Choose PocketGuard?

Simple and user-friendly, it tells you how much you can safely spend. - Features:

- Real-time balance tracking.

- Bill management options.

- Savings suggestions.

Section 4: More Free Personal Finance Apps for 2025

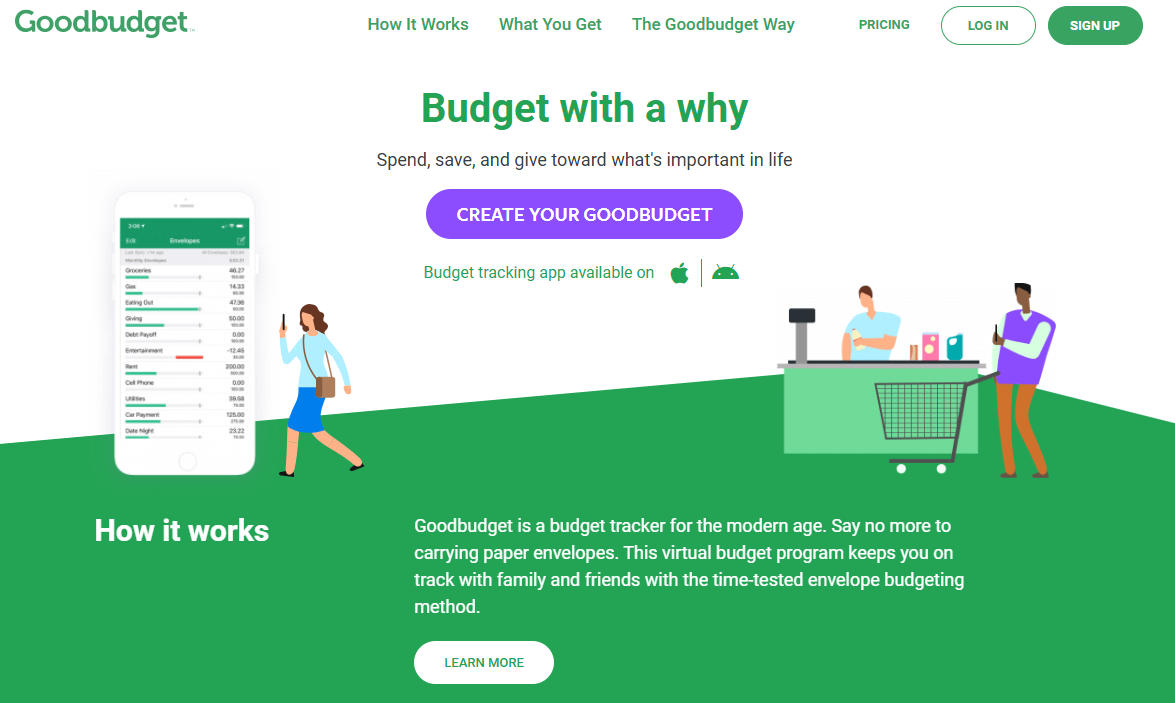

4. Goodbudget

- Why Choose Goodbudget?

Goodbudget uses the envelope budgeting system, making it easy to manage your money. It’s a great option for couples or anyone who prefers manual control over transactions. - Features:

- Digital “envelopes” for each spending category.

- Ideal for shared budgeting with partners.

- Free plan includes 20 envelopes.

- Best For: People who want a hands-on approach and prefer not to link their bank accounts.

5. Honeydue

- Why Choose Honeydue?

Honeydue focuses on shared finances, making it one of the best apps for couples. It encourages transparency and simplifies money discussions. - Features:

- Syncs accounts from both partners.

- Custom spending categories and alerts.

- In-app chat for financial conversations.

- Best For: Couples who want to manage shared expenses.

6. Monarch

- Why Choose Monarch?

Monarch is ideal for self-employed individuals or those with multiple income sources. It provides tax-friendly tools and a clear financial overview. - Features:

- Tags transactions as tax-related for deductions.

- Advanced planning tools for long-term goals.

- Unlimited collaborators for joint projects.

- Best For: Freelancers and business owners.

Conclusion: Take Control of Your Financial Future

Personal finance apps are like having a financial advisor in your pocket. They simplify budgeting, saving, and tracking expenses, making it easier to reach your financial goals. Whether you want to save for a house, pay off debt, or simply understand where your money goes, there’s an app for you.

Next Steps:

- Download one or more of the apps mentioned.

- Explore their features to find the best fit for your needs.

- Start small by setting one financial goal, like creating a budget or saving $100 this month.

With these tools, 2025 can be the year you unlock your financial potential!

FAQs

1. Are these apps really free?

Yes, all the apps listed offer free versions. However, some have premium features that cost extra.

2. Is it safe to link my bank accounts?

Most apps use strong encryption and secure connections to protect your data. Always check for privacy policies before linking accounts.

3. Can I use these apps if I don’t know much about finance?

Absolutely! These apps are designed to be user-friendly. Many also provide guides and tutorials to help beginners.

4. What if my income is irregular?

Apps like YNAB and Monarch work well for people with irregular income. They help plan budgets based on priorities.

5. Can couples use these apps together?

Yes! Apps like Goodbudget and Honeydue are perfect for managing shared expenses and goals.

6. Do these apps work offline?

Some apps, like Goodbudget, allow offline manual entries, but most require internet access to sync real-time data.

7. Can I switch apps later?

Yes, you can export data from most apps if you decide to try another one.

I am a passionate digital marketer with a strong expertise in SEO and article writing. With years of experience in crafting compelling content and optimizing it for search engines, I help businesses enhance their online visibility and drive organic traffic. Whether it’s creating engaging blog posts or implementing effective SEO strategies, I am dedicated to delivering results that make an impact.