Forming an LLC can seem complex, but it’s not as hard as you think. This guide will walk you through the steps to establish your own LLC.

Starting a business is exciting, but there are many important decisions to make. One crucial choice is deciding on the right business structure. Many entrepreneurs choose to form a Limited Liability Company, or LLC. Why? An LLC combines the flexibility of a partnership with the liability protection of a corporation.

This means you get the best of both worlds: personal asset protection and operational flexibility. In this blog post, we will explain how to form an LLC, breaking down the process into simple, easy-to-follow steps. By the end, you’ll be ready to start your own LLC with confidence.

Introduction To Llcs

Starting a business is an exciting journey. Choosing the right structure is key. One popular choice is the Limited Liability Company (LLC). This structure offers many benefits for new business owners. Let’s dive into what an LLC is and why it might be the best fit for your business.

What Is An Llc?

An LLC is a business structure in the United States. It combines the benefits of a corporation with those of a partnership or sole proprietorship. It offers flexibility and protection to its owners, known as members.

Here are some key features of an LLC:

- Limited Liability: Members are not personally liable for company debts.

- Pass-through Taxation: Profits and losses pass through to members’ personal tax returns.

- Flexibility: Fewer regulations and formalities than corporations.

Benefits Of An Llc

Forming an LLC comes with several advantages:

- Protection of Personal Assets: Your personal assets are safe from business debts.

- Tax Flexibility: Choose how you want your LLC to be taxed.

- Less Paperwork: Fewer formalities and regulations than corporations.

- Credibility: An LLC can add credibility to your business.

- Flexible Management: Manage your LLC in a way that suits your needs.

Below is a table summarizing the main benefits of an LLC:

| Benefit | Description |

|---|---|

| Protection of Personal Assets | Your personal assets are safe from business debts. |

| Tax Flexibility | Choose how you want your LLC to be taxed. |

| Less Paperwork | Fewer formalities and regulations than corporations. |

| Credibility | An LLC can add credibility to your business. |

| Flexible Management | Manage your LLC in a way that suits your needs. |

These benefits make an LLC an attractive option for many entrepreneurs. Whether you are starting a small business or a larger venture, an LLC offers a blend of protection and flexibility.

Choosing A Business Name

Choosing a business name is a crucial step in forming an LLC. Your business name represents your brand and should be memorable. It should also comply with state regulations. Let’s break down the process into two essential parts: understanding name requirements and checking name availability.

Name Requirements

Each state has specific rules for business names. Your LLC name must include words like “Limited Liability Company” or abbreviations such as “LLC” or “L.L.C.”. The name should not include words that might confuse it with a government agency. Avoid terms like “Bank”, “Insurance”, or “Corporation” unless allowed by the state.

It’s essential to ensure that your business name is unique. It must not be the same as any other registered business in your state. This helps avoid legal issues and confusion among customers. A unique name sets your brand apart.

Checking Name Availability

Once you have a name in mind, check its availability. Start by searching the state’s business name database. Most states offer an online tool for this purpose. Simply enter the name to see if it’s already taken.

If the name is available, you can reserve it for a small fee. This gives you time to complete your LLC formation without losing your chosen name. Some states also require you to publish a notice of intent to use the name in a local newspaper.

Additionally, check the availability of the domain name. A matching domain name helps in establishing an online presence. Use domain search tools to see if the web address is available. If it is, consider securing it along with your business name.

Selecting A Registered Agent

Forming an LLC involves several steps. One key step is selecting a registered agent. A registered agent is crucial for your LLC. They handle important legal documents and notices. Choosing the right one can impact your business.

Role Of A Registered Agent

A registered agent receives official mail for your LLC. This includes legal papers, tax notices, and compliance information. They ensure you get these documents promptly. This helps your business stay in good standing.

They must be available during business hours. This is required by law. Their job is vital to maintaining your LLC’s legal status.

Choosing The Right Agent

Picking the right agent is important. They must be reliable and trustworthy. They should have a physical address in your LLC’s state. Post office boxes are not accepted.

Consider their reputation. Look at reviews and feedback from other businesses. This can give you an idea of their reliability.

Some businesses use professional services. These services specialize in being registered agents. They know the laws and requirements. They can be a good option if you want peace of mind.

Ensure the agent you choose is accessible. They must be easy to contact. If they receive important documents, you need to know right away.

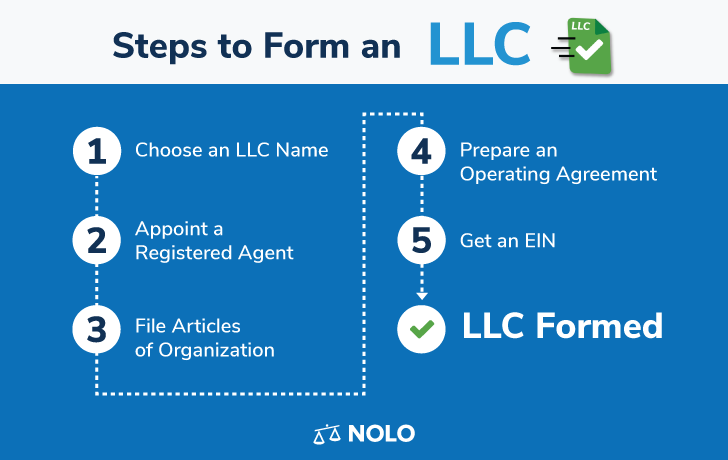

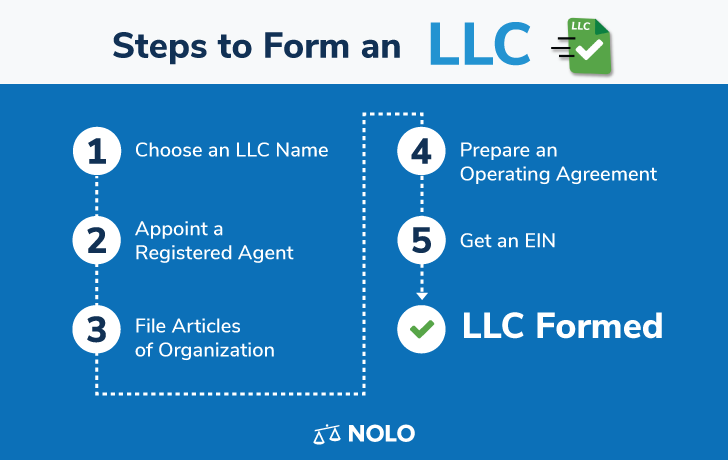

Credit: www.nolo.com

Filing Articles Of Organization

Forming an LLC involves several important steps. One key step is filing the Articles of Organization. This document officially registers your LLC with the state. It sets out basic information about your new business. Understanding this process is crucial for a smooth start.

Necessary Information

To file the Articles of Organization, you need specific details. Include the LLC’s name. Make sure it is unique and follows state rules. Provide the address of the principal office. This is where the main business activities occur.

Include the name and address of the registered agent. The registered agent will receive legal documents for the LLC. You also need to state the LLC’s purpose. Some states require a general statement, while others need more detail.

Filing Process

Filing the Articles of Organization can be done online or by mail. Check your state’s website for options. Download the form if mailing. Fill out all required fields. Double-check for accuracy to avoid delays.

Pay the filing fee. Fees vary by state. Submit the form along with the payment. Some states offer expedited processing for an extra fee. Once filed, you will receive a confirmation. Keep this for your records.

Completing this step officially forms your LLC. You can now start operating your business legally. Understanding this process ensures you meet all legal requirements.

Creating An Operating Agreement

Creating an Operating Agreement is a crucial step in forming an LLC. This document outlines the ownership and member duties of the LLC. It is essential to have a clear and detailed Operating Agreement to avoid conflicts and ensure smooth operations.

Purpose Of An Operating Agreement

The main purpose of an Operating Agreement is to define the internal operations of the LLC. It sets the rules and regulations that members must follow. This agreement helps in managing business operations and decision-making processes.

Without a well-drafted Operating Agreement, state laws may govern your LLC. This could lead to unwanted outcomes. Thus, having this document provides legal protection and clarity.

Key Components

An Operating Agreement should include several key components. These components ensure the proper functioning of the LLC. Below are some of the most important elements:

- Member Information: Names and addresses of all LLC members.

- Ownership Structure: Details of each member’s ownership percentage.

- Management: Outline whether the LLC is member-managed or manager-managed.

- Voting Rights: Rules for voting on important business decisions.

- Profit and Loss Distribution: How profits and losses are shared among members.

- Meetings: Guidelines for holding regular meetings and decision-making processes.

- Member Changes: Procedures for adding or removing members.

- Dissolution: Steps to dissolve the LLC if needed.

These components ensure that all members are on the same page. They help prevent misunderstandings and conflicts. A well-drafted Operating Agreement protects the interests of all members.

Credit: www.nolo.com

Obtaining An Ein

Forming an LLC is an important step for any business owner. After establishing your LLC, obtaining an EIN is crucial. An EIN, or Employer Identification Number, is essential for tax and business purposes. This section will guide you through the process of obtaining an EIN.

What Is An Ein?

An Employer Identification Number (EIN) is a unique number assigned by the IRS. It helps identify your business entity for tax purposes. Think of it as a Social Security number for your business. Without an EIN, you cannot hire employees, open a business bank account, or file taxes.

How To Apply

Applying for an EIN is a straightforward process. Follow these steps:

- Visit the IRS website.

- Click on the “Apply for an EIN online” link.

- Read the instructions provided and click “Begin Application.”

- Select the appropriate entity type for your business.

- Fill in the required information, including your LLC’s name and address.

- Submit the application.

Once you submit the application, you will receive your EIN immediately. Ensure you save or print the confirmation for your records.

Applying for an EIN online is the fastest method. Alternatively, you can apply by fax or mail. For these methods, download and complete Form SS-4 from the IRS website. Then, send it to the appropriate address or fax number listed in the instructions.

Meeting State And Federal Requirements

Forming an LLC is a structured process. Meeting state and federal requirements is crucial. Understanding these steps ensures your business complies with all legal standards.

State Requirements

Each state has its own rules for LLCs. Here are some common steps:

- Select a unique business name: Your LLC’s name must be different from other registered businesses in your state.

- File Articles of Organization: This document officially registers your LLC with the state.

- Appoint a registered agent: This person or service receives legal papers for your LLC.

- Create an Operating Agreement: This document outlines your LLC’s management structure and operating procedures.

- Comply with publication requirements: Some states require you to publish a notice of your LLC formation in local newspapers.

Check with your state’s business filing office for specific details.

Federal Requirements

Meeting federal requirements is also important. Here are key steps:

- Obtain an EIN: An Employer Identification Number (EIN) is necessary for tax purposes. You can apply for an EIN through the IRS website.

- Register for federal taxes: Depending on your business type, you may need to register for various federal taxes.

- Comply with employment laws: If you have employees, follow all federal employment laws and regulations.

Ensure you understand federal obligations to avoid any legal issues.

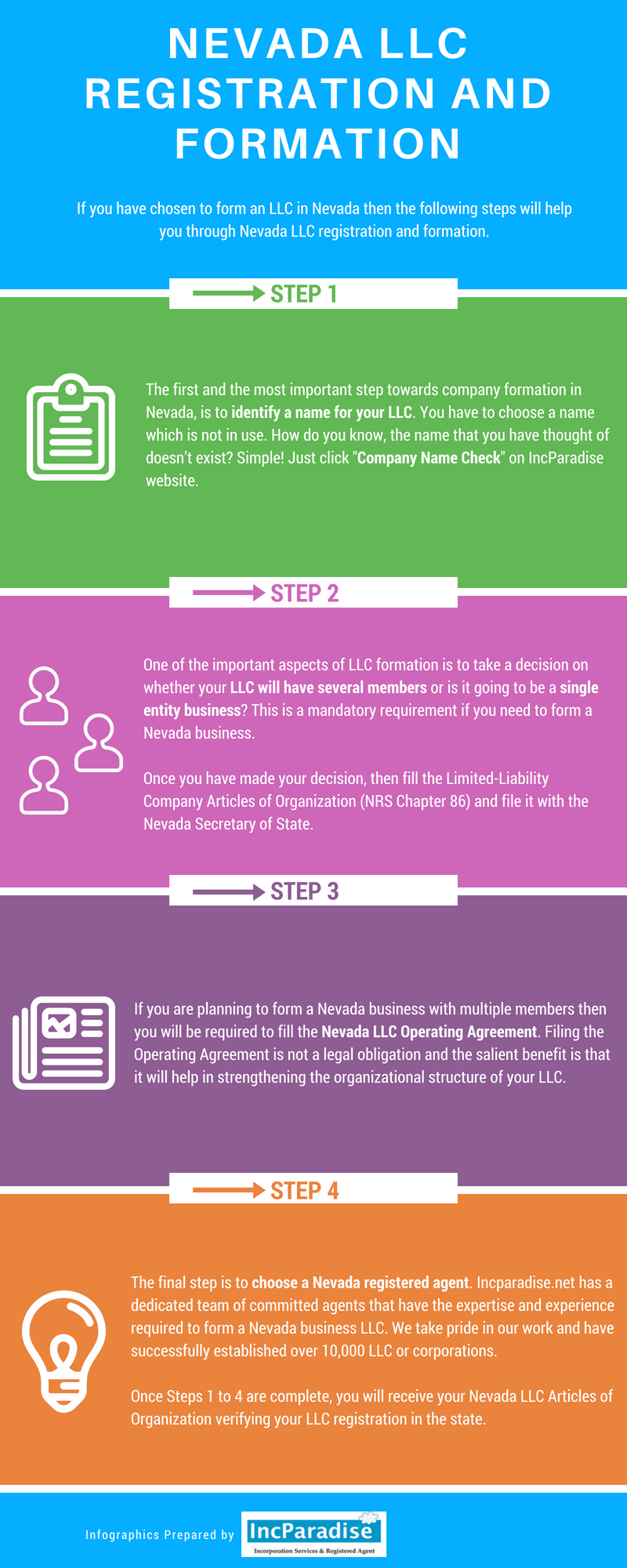

Credit: incparadise.net

Maintaining Your Llc

Maintaining your LLC is crucial for its success. It involves keeping up with various requirements. This ensures your LLC remains in good standing. It also helps you avoid penalties and legal issues. Below are key aspects to focus on.

Annual Reports

Many states require LLCs to file annual reports. These reports update the state on your LLC’s status. They include information like your business address and member details. Filing these reports on time is essential. Missing deadlines can lead to fines. It may even result in your LLC being dissolved.

Ongoing Compliance

Ongoing compliance involves various tasks. You must keep your business licenses and permits current. Your LLC must also adhere to state and federal regulations. This includes paying taxes and maintaining accurate records. Regularly review your LLC’s compliance status. This helps you stay ahead of any issues.

Frequently Asked Questions

What Is An Llc?

An LLC is a Limited Liability Company. It provides personal liability protection. It combines the benefits of a corporation and a partnership.

How Do I Form An Llc?

To form an LLC, choose a business name, file Articles of Organization, and create an Operating Agreement. Check state-specific requirements.

What Are The Benefits Of An Llc?

An LLC offers personal liability protection, tax flexibility, and less paperwork. It is suitable for small businesses and entrepreneurs.

How Much Does It Cost To Form An Llc?

The cost to form an LLC varies by state. It typically ranges from $50 to $500. Check your state’s specific fees.

Conclusion

Starting an LLC can be straightforward with proper steps. Plan carefully. Choose a unique name. File necessary paperwork. Get your EIN and licenses. Consider consulting a lawyer. Maintain good records. Follow state regulations. Doing this will help protect your business.

Plus, it can provide tax benefits. Creating an LLC is a smart choice for many entrepreneurs. It offers flexibility and protection. Now, you are ready to form your LLC and start your business journey with confidence.

I am a passionate digital marketer with a strong expertise in SEO and article writing. With years of experience in crafting compelling content and optimizing it for search engines, I help businesses enhance their online visibility and drive organic traffic. Whether it’s creating engaging blog posts or implementing effective SEO strategies, I am dedicated to delivering results that make an impact.